26% of Family Offices Invest in Crypto: Goldman Sachs Survey

The banking giant Goldman Sachs determined in a recent study that 32% of family offices across the globe have exposure to digital assets, NFTs, or DeFi, while 26% have explicitly invested in cryptocurrencies.

The results from the 2021 research showed that only 16% of the wealth management firms were HODLers.

Two Years Difference

Goldman Sachs contacted 166 family offices in the Americas, Europe, the Middle East and Africa (EMEA), and Asia-Pacific (APAC) to determine how their investment strategy has altered in the past few years.

The study from 2021 estimated that 16% of the respondents have invested in digital currencies, while the current figures have risen to 26%. Nonetheless, interest in the sector has dropped significantly:

“Within the digital-asset ecosystem, family offices have become more decisive about cryptocurrencies: the proportion that is invested has risen from 16% in 2021 to 26%. However, the proportion that is not invested and not interested in the future has risen from 39% to 62%, and those that are potentially interested in the future has fallen from 45% to 12%.”

Goldman Sachs further revealed that 32% of the participants currently have some exposure to digital assets (including cryptocurrencies, stablecoins, non-fungible tokens (NFTs), decentralized finance (DeFi), and blockchain-related funds).

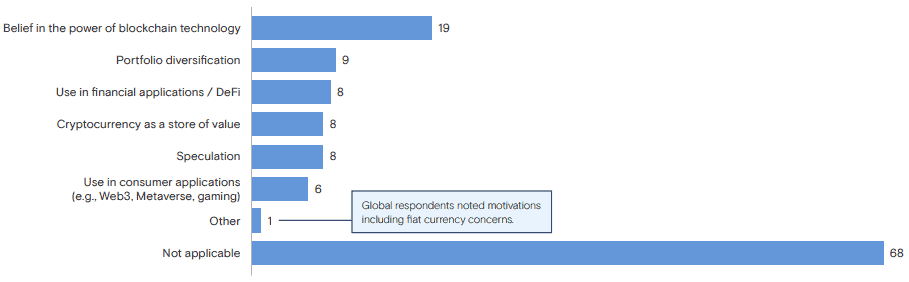

The primary motivation for those who have entered the ecosystem is the belief in the power of blockchain technology (19%). 9% have joined the industry to diversify their portfolios, whereas 8% view digital currencies as a store of value. In addition, 8% have purchased bitcoin or altcoins, hoping to profit in the future or simply speculating.

Most HODLers (30%) are from the APAC region. In addition, 27% of the family offices without crypto exposure from that area remain interested in the future.

The EMEA is on the opposite corner, with only 15% cryptocurrency investors and 79% who say they are not intrigued to join the pack.

Hong Kong and Singapore Emerge as Leaders

Another recent study conducted by KPMG China and Aspen Digital concluded that nearly 60% of family offices and high-net-worth individuals (HNWIs) from Hong Kong and Singapore have invested some of their wealth in digital assets.

“For HNWIs and family offices, there is a real possibility of a big upside, so they may think, why not stick 2 or 3 percent of my portfolio in that and see what happens,” Paul McSheaffrey – Senior Banking Partner at KPMG China – explained.

The research revealed that the two largest cryptocurrencies by market capitalization – bitcoin (BTC) and ether (ETH) – are the most popular digital assets in both regions.

The post 26% of Family Offices Invest in Crypto: Goldman Sachs Survey appeared first on CryptoPotato.