Spot Ethereum ETFs Shine With Strong Inflows Despite Price Struggles – Details

Since reaching a new all-time high, Ethereum has retested the $4,200 price level in a bearish style. Over the past few days, ETH has been on a downward trend in terms of price action, but the altcoin has demonstrated significant bullish performance in terms of its Spot Exchange-Traded Funds (ETFs).

Investors Pour Into Ethereum ETFs

Ethereum’s ongoing waning price action does not seem to have affected investors’ sentiment, especially on the institutional level. The leading altcoin has displayed a notable bullish performance in its Spot Ethereum ETFs.

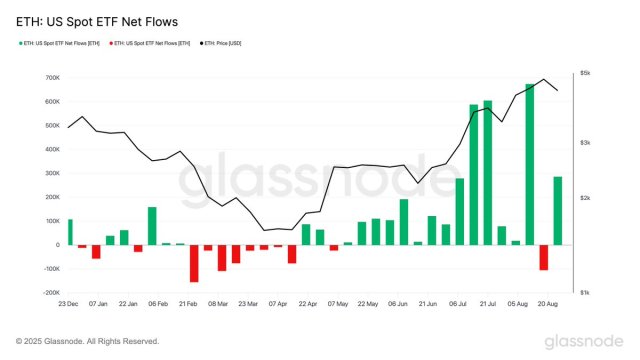

Glassnode, a leading financial and on-chain data analytics platform, reported the resurgence in investor sentiment in a recent post on the social media platform X. The report from the on-chain platform shows that spot ETH ETFs have just logged a week of substantial inflows after recording significant outflows in the previous week.

This renewed inflow over the week underscores rising investor appetite for the altcoin even though it is facing repeated price fluctuations. Furthermore, the consistent flow of money into these funds indicates that both institutional and individual investors are focusing on ETH’s long-term growth potential rather than just short-term market fluctuations.

According to the platform, there were huge inflows of over 286,000 ETH into the spot Ethereum ETFs last week. It is worth noting that this massive capital marks one of the strongest weekly inflows since the funds were introduced late last year.

Another key development seen on the chart is that the last time the funds saw negative outflows was in early May. After a negative week, the funds experienced 14 consecutive weeks of notable inflows, which implies that investors are increasing their exposure to ETH.

Even as ETH closed the week near $4,400, investors continued to invest in the altcoin through the funds. With ETH price action still fluctuating, the tenacity of ETF demand indicates that investors are becoming more confident in the asset’s status as a pillar of the digital economy.

A Shift In Capital From Bitcoin To ETH

Spot Ethereum ETFs have gained serious upward traction against their BTC counterparts. While ETH has seen unprecedented inflows in August 2025, Reaper, a web3 investor, claims that this development could signal a potential capital rotation from BTC to the altcoin. Such a trend is likely to ignite the most explosive altcoin season this year.

In August, Reaper noted that over $4 billion in net inflows were made into spot ETH ETFs alone throughout the month. Meanwhile, Bitcoin spot ETFs suffered about $803 million in outflows during the same time frame.

According to the investor, these massive inflows coincide with notable on-chain accumulation of over 1.5 million ETH, valued at $8 billion, by large holders. This institutional demand and on-chain accumulation underscore a shift from BTC dominance to Ethereum’s ecosystem.

Amid this wave of capital, Reaper highlighted that smaller-cap ETH tokens have not yet experienced a significant influx of capital into their market sector. However, he anticipates this segment of the market to heat up in the upcoming months.

Featured image from iStock, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.