Bitmine Accumulates Nearly 70K Ethereum But Faces $4.25B Unrealized Loss At Current Prices

Ethereum has lost the $3,000 mark and hasn’t been able to reclaim it for days, reinforcing growing concerns that the market may be entering a deeper corrective phase. Selling pressure continues to mount as traders unwind positions and sentiment shifts toward caution.

The broader crypto market is also weakening, adding to speculation that a bear market could be forming earlier than many expected. Fear and uncertainty now dominate social metrics, derivatives data, and spot flows, with investors questioning whether ETH has already set its cycle top. Yet, despite the pessimism and deteriorating price structure, not all players are retreating. In fact, some of the largest market participants are aggressively accumulating.

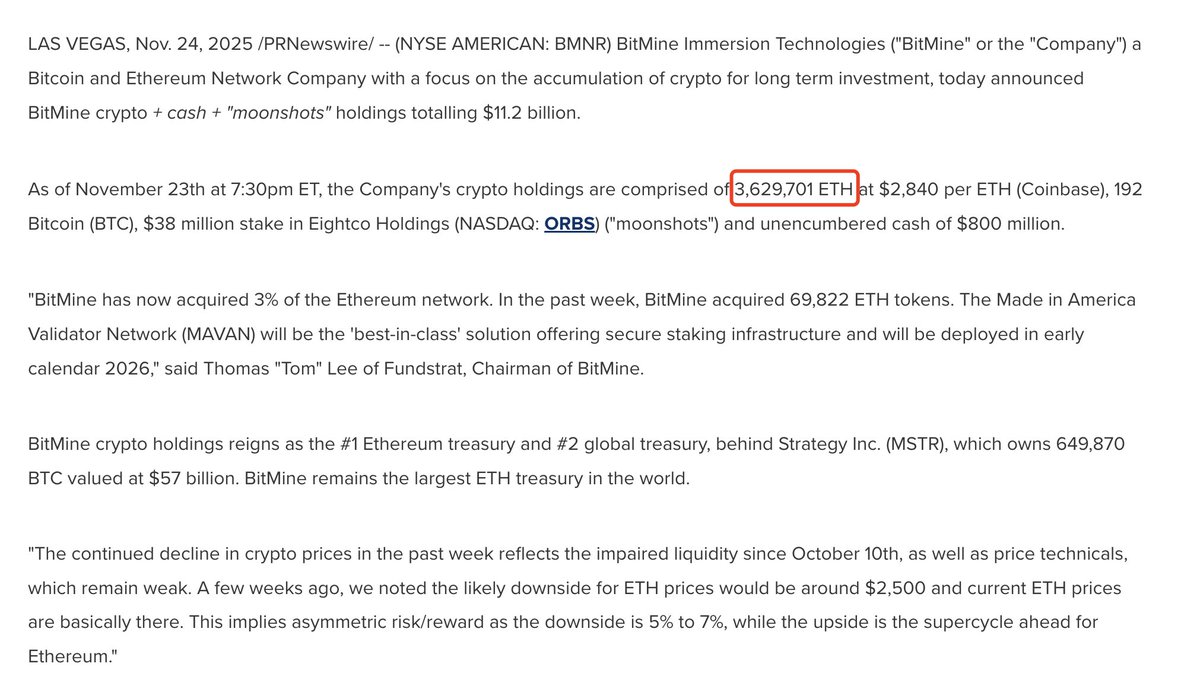

New data from Lookonchain reveals that Tom Lee’s Bitmine bought 69,822 ETH valued at $197.25 million last week alone. This brings their total holdings to a staggering 3,629,701 ETH worth approximately $10.25 billion.

Bitmine Faces Massive Unrealized Loss as Market Awaits Direction

According to a press release from Bitmine, the firm’s average buying price sits near $3,997, leaving its position at an unrealized loss of roughly $4.25 billion at current market levels. This disclosure highlights the scale of conviction behind Bitmine’s accumulation strategy, but it also underscores how deeply Ethereum has retraced since its recent highs. The continued drawdown reflects the broader uncertainty gripping the market, where fear and hesitation are overpowering momentum and liquidity remains thin.

The market is now entering a critical phase that could define price behavior for the coming months, as traders assess whether ETH can stabilize and begin reclaiming lost ground. Many analysts argue that despite the sharp retracement, Ethereum remains positioned for a recovery, especially if macro conditions improve and selling pressure eases. They point out that historically, similar periods of aggressive whale accumulation during market weakness have preceded strong rebounds and renewed investor confidence.

However, others warn that if ETH fails to regain momentum above key psychological levels, downside continuation could deepen. This moment has therefore become a dividing line between bullish expectation and bearish caution.

Ethereum Price Action Shows Weak Recovery Attempts Amid Bearish Structure

Ethereum’s price action on the daily chart continues to reflect a market struggling to regain upward momentum after losing the $3,000 level. The recent bounce toward $2,900 shows a temporary reaction, yet the broader structure remains bearish as ETH trades below the 50-day, 100-day, and 200-day moving averages.

This alignment of moving averages — with the faster averages positioned beneath the slower ones — confirms a sustained downward trend that has been developing since early October.

The chart also shows declining highs and lower lows, reinforcing that buyers have not yet regained control. Volume spikes during selloffs indicate that bearish activity is driving market movement more than accumulation. Despite brief recoveries, each attempt to push higher has been rejected near resistance around the $3,150–$3,250 range, suggesting that sentiment remains fragile.

Additionally, the red 200-day moving average near the $3,500 zone is now a critical long-term threshold. If ETH cannot reclaim this region in the coming weeks, the probability of continued consolidation or even deeper correction increases.

For now, Ethereum remains in a vulnerable position, requiring stronger demand to shift the trend back in favor of bulls.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.