Bitcoin Investors Suffer $4.5B Loss, Most In 3 Years

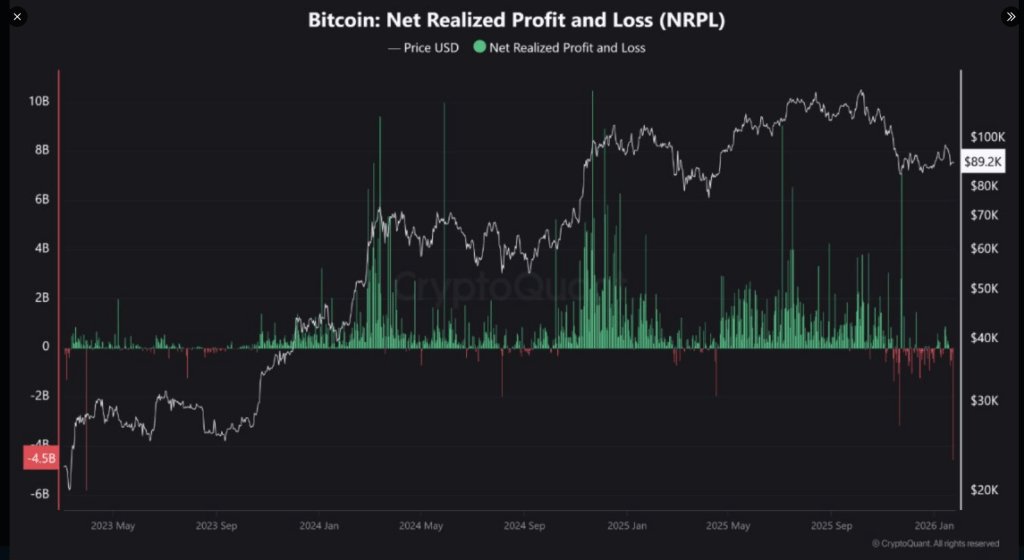

Reports note that Bitcoin holders realized large losses as prices slid, and the headline number is hard to ignore. According to on-chain tracker CryptoQuant, about $4.5 billion in net losses was recorded on January 23.

Related Reading

That number reflects moved coins sold at prices lower than when they were bought. It is a big transfer of paper pain into real losses.

Realized Losses Spike

While the dollar figure grabs attention, the meaning is what matters. Many who bought late in the run higher are choosing to sell rather than hold through more decline. That behavior shows frustration.

Reports say the Net Realized Profit and Loss metric tallies this by comparing sell prices to purchase prices, and a negative reading this large signals a wave of capitulation.

Some larger, long-term holders have been quieter. Their activity appears muted while smaller and mid-term participants make the day-to-day moves.

According to analyst posts on CryptoQuant, this mix — quiet big holders and active smaller sellers — is common during corrective stretches. It does not automatically mean the market is broken; it means sentiment has shifted toward caution.

$4.5 Billion in Realized Loss on Bitcoin

“Highest amount of realized losses in three years. The last time this occurred in Bitcoin, the price was trading at $28,000 after a brief correction period that lasted about a year.” – By @gaah_im pic.twitter.com/OJ7bbL3RSC

— CryptoQuant.com (@cryptoquant_com) January 26, 2026

Bitcoin Price Action

Midway through the week, Bitcoin traded around the mid-$80,000s, well below the $90,000 mark that some investors had eyed as a key level.

Market chatter shows traders watching macro cues like the US Federal Reserve and inflation data for guidance.

Volatility has not disappeared; it has simply become more tied to broader economic signals than to isolated crypto headlines.

Whale addresses appeared to step in at times, helping to hold local price floors. But many traders remain cautious.

Reports note that geopolitical headlines can cause quick swings, yet the current movement looks more like slow digestion of profit and repositioning than explosive panic selling.

Activity on spot exchanges and ETF flows has been variable, reflecting the mixed mood across the market.

Related Reading

Capitulation Has Come Before

Similar loss spikes were seen in March 2023, when realized losses reached close to $6 billion, and in November 2022, when losses hit roughly $4.3 billion.

These events were followed by consolidation and then eventual recovery. Based on reports from analytics firms and market observers, spikes in realized losses can mark the late stages of selling pressure, after which the market sometimes finds a base.

Featured image from Pexel, chart from TradingView