Bitcoin (BTC) Slides 13%: Is This the Ultimate ‘Buy the Dip’ Zone?

Bitcoin has declined by more than 13% over the past week and is now trading under pressure near $105,000. The recent move lower comes amid increased focus on gold markets and a broader correction across risk assets.

Still, some traders see this range as an opportunity to re-enter the market.

Market Pullback Brings Price Near Buy Zone

Bitcoin is priced around $105,000 at press time, based on CoinGecko data. Analyst Michaël van de Poppe says attention is shifting away from Bitcoin, but the current range could offer value.

“In these ranges, it’s getting into buy the dip area,” he posted.

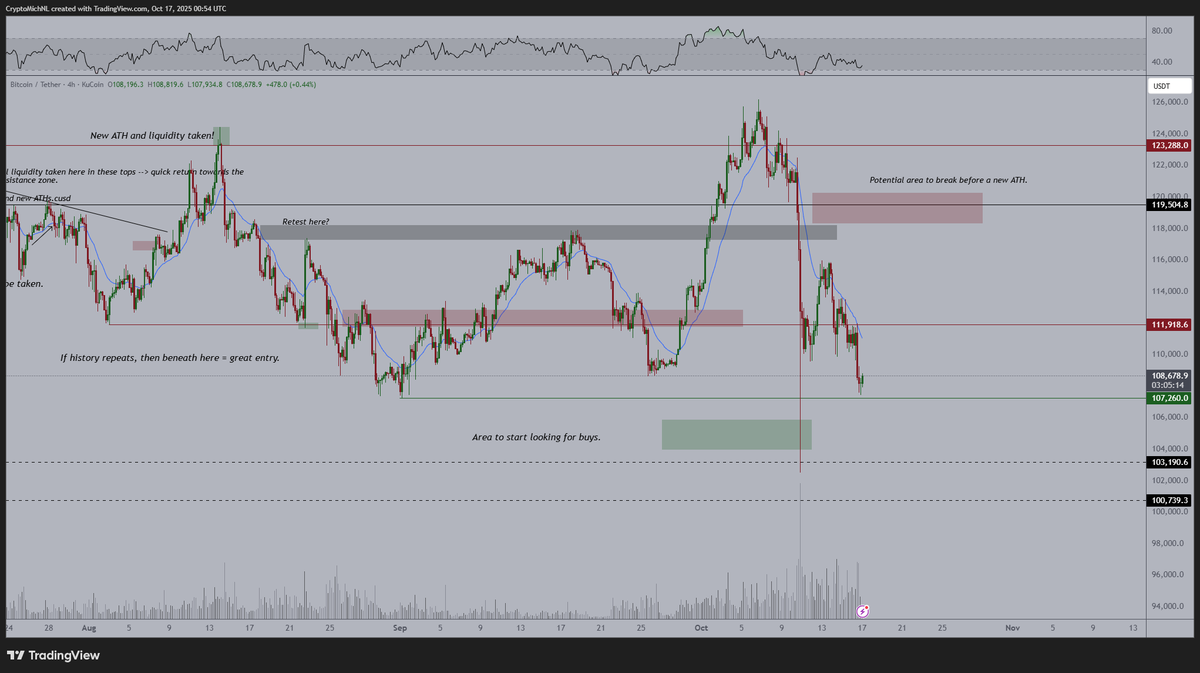

A green zone between $106,000 and $104,000 is highlighted as a possible entry range. This level has held as support in past corrections. If the price continues to slide, additional levels to watch are $103,190 and $100,700.

For momentum to shift upward, van de Poppe says Bitcoin would need to break above $112,000. This aligns with short-term resistance near $111,900 on the chart. A move through that range could lead to a push toward the $119,500 area, followed by a potential retest of the all-time high.

Recent price action shows liquidity was taken near the highs, followed by a sharp move lower. A red shaded area near $120,000 is identified as the zone that needs to be cleared before a new high can form.

21-Week EMA Holds Mid-Cycle Relevance

On the weekly chart, Bitcoin is trading just under the 21-week EMA. This moving average has acted as trend support during previous uptrends. Analyst Rekt Capital says a close back above the EMA is needed to keep the structure intact.

Bitcoin is currently deviating below the 21-week EMA (green) and will need to Weekly Close above it to sustain it as support$BTC #Crypto #Bitcoin https://t.co/ZP2hs31TB1 pic.twitter.com/mys182IB9V

— Rekt Capital (@rektcapital) October 16, 2025

A broader demand zone between $93,000 and $108,000 has also been marked. This range previously served as a consolidation zone before the rally earlier this year.

Trading Volume Increases as Price Drops

Despite the decline, trading volume has picked up. As CryptoPotato reported, data shows Bitcoin’s weekly volume is at its highest level since March. This suggests increased participation, even as the asset trades near short-term support.

Meanwhile, Gold has continued to attract capital during this period. Economist Peter Schiff commented that Bitcoin’s recent dip was a “warning,” calling attention to gold’s stronger performance over recent months.

Bitcoin remains in a tight range, with traders watching the $112,000 and $104,000 levels for the next clear signal.

The post Bitcoin (BTC) Slides 13%: Is This the Ultimate ‘Buy the Dip’ Zone? appeared first on CryptoPotato.