Ethereum Treasury Firm BitMine Announces Crypto’s First-Ever Dividend Payment – Report

2025 has been a year of ups and downs for the cryptocurrency industry, with the performance of digital asset treasuries (DATs) a perfect example of this trend. While Bitcoin and Ethereum treasury firms like Strategy and BitMine seem to be weathering the recent storm, other companies have succumbed to the bursting bubble of DATs.

For instance, BitMine has disclosed its plans to become “the first large-cap cryptocurrency company to declare annual dividends.” This announcement came as the Ethereum treasury firm released its fiscal year results on Friday, November 21.

BitMine To Pay $0.01 Dividend Per BMNR Share

In a press release on Friday, the largest Ethereum treasury company, BitMine, reported a net income of $328 million—equal to $13.39 in fully diluted earnings per share (BMNR). The firm also shared its plan to become the first large-cap crypto company to pay dividends to its shareholders.

The Ethereum treasury company intends to pay an annual dividend of $0.01 per BMNR share, as it looks to return some value to shareholders amid the weakening crypto market. According to the press release, the payable date for the dividend is set at December 29, 2025, with BitMine’s next shareholder meeting to be held in January 2026.

BitMine’s Chairman, Tom Lee, said in the release:

BitMine continues to execute at the highest level. The company is well positioned in 2026 and we look forward to commencing ETH staking with our MAVAN, or Made in America Validator Network, in early calendar 2026.

The crypto treasury company explained its plans to launch the Made in America Validator Network (MAVAN) to stake its Ether holdings. After vetting several native staking providers, BitMine revealed that it has selected three initial pilot partners to test out their staking capabilities using a small portion of its ETH.

The BMNR stock is currently valued at around $26, reflecting an over 25% decline in the past week. Meanwhile, the share price is significantly away from its 2025 high of $135, reached shortly after Bitmine announced its Ethereum acquisition strategy.

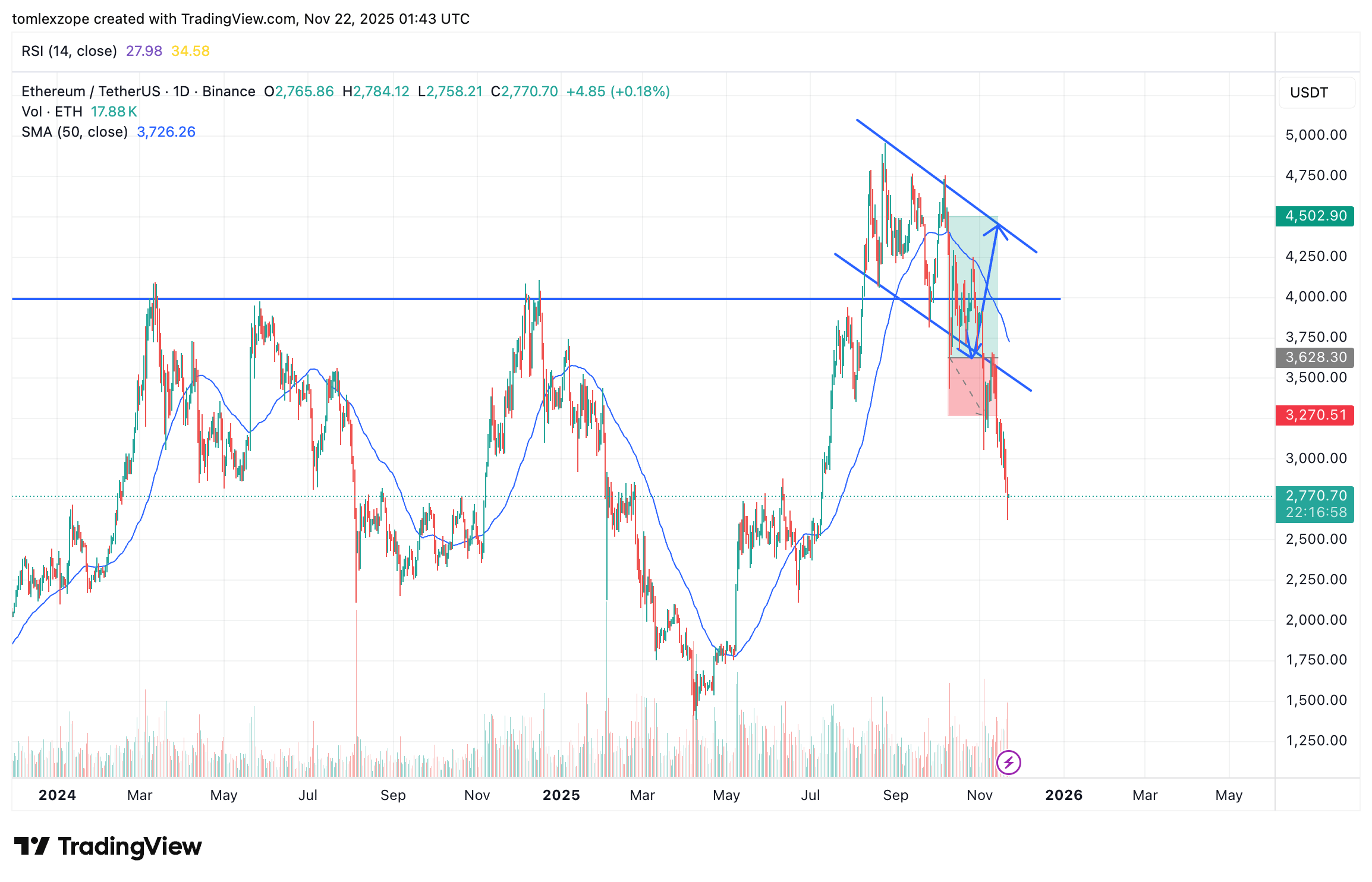

The industry-wide struggles of these digital asset treasuries can be attributed to the pullback of the crypto market in the second half of the year, especially in the fourth quarter. While the price of Ethereum continues to show weakness, recently falling to around $2,650, BitMine’s chairman believes that a market recovery is inevitable.

BitMine Continues ETH Buying Spree

BitMine’s faith in the eventual recovery of the Ethereum price can be seen in its relentless acquisition strategy. As Bitcoinist reported, the firm purchased about 21,054 ETH (worth about $66.57 million) on Wednesday, November 19.

As of a Thursday report, the unrealized losses of BitMine’s Ethereum holdings were nearing $4 billion. Notably, the DAT company holds roughly 3.55 million ETH tokens—worth about $10 billion—acquired at an average cost of around $3,120.

The price of ETH on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.