Ethereum ETFs Hit $726M ATH: BlackRock Alone Drew $500M

Data shows the US Ethereum spot ETFs have just seen their biggest day of inflows, driven largely by demand on BlackRock and Fidelity.

Ethereum Spot ETFs Have Seen A Sharp Uptick In Demand

According to data from Farside Investors, July 16th was a big day for the US Ethereum spot ETFs, with total inflows crossing the $726 million mark, a new all-time high (ATH). The spot exchange-traded funds (ETFs) refer to investment vehicles that allow investors to gain exposure to an asset without having to directly own it. In the case of cryptocurrencies, this means that ETF holders don’t have to manage digital asset wallets or navigate exchanges. For traditional investors, this fact can make spot ETFs a convenient way to explore the market.

Ethereum spot ETFs gained approval in the US nearly one year ago. Since then, demand has varied, but the asset has lately been on a positive run of inflows, with the most recent numbers showing momentum is only accelerating.

Below is a table that shows how the netflow related to the various Ethereum spot ETFs has looked during the last couple of weeks.

Looks like BackRock's ETF has consistently led in terms of inflows | Source: Farside Investors

As is visible, notable daily inflows of around $200 million or more were already happening into the US Ethereum spot ETFs during the past week, indicating that demand from institutional entities was solid, but with the latest record-breaking day, things have clearly kicked into an even higher gear.

BlackRock’s ETHA saw the largest share of July 16th inflows at almost $500 million. Fidelity’s FETH was a distant second, purchasing about $133 million in the cryptocurrency on behalf of its users.Capital has poured into the spot ETFs as Ethereum has seen a breakout above the $3,000 level, which has so far brought it to $3,400 for the first time since January.

Following this rally, institutional investors aren’t the only ones paying attention to ETH, as data from the analytics firm Santiment shows a spike in retail interest.

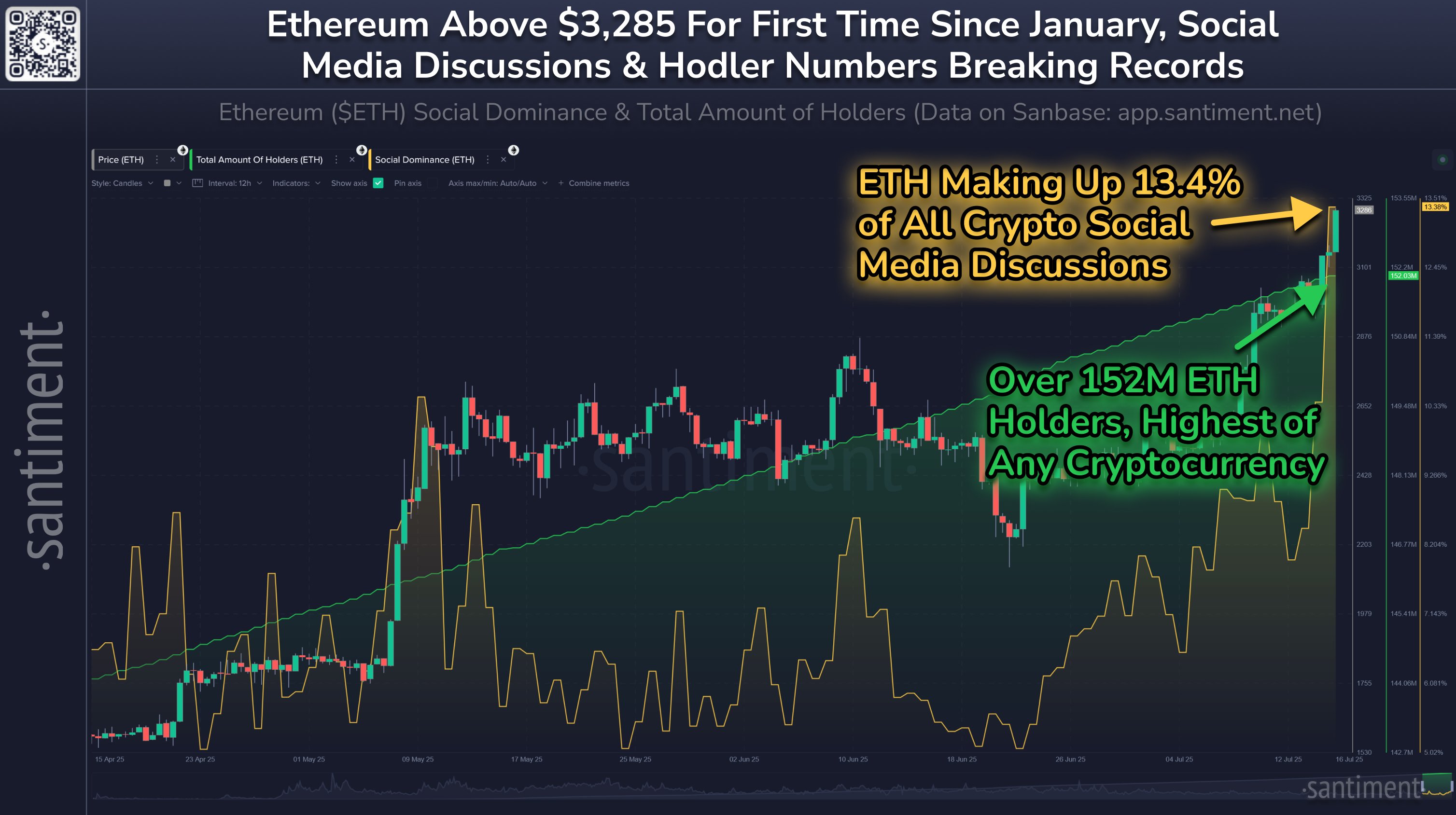

The trend in the Social Dominance and Total Amount Of Holders for ETH over the last few months | Source: Santiment on X

In the chart, Santiment has attached the data of the Social Dominance, an indicator that tells us about the discussion share that Ethereum occupies on the major social media platforms relative to other cryptocurrencies.

Since retail investors far outweigh the larger holders in terms of numbers, this metric ends up reflecting the behavior of the small hands. From the graph, it’s apparent that the ETH Social Dominance has seen a huge spike alongside the price surge, with 13.4% of all digital asset discussions on social media now involving the coin.

Clearly, retail is taking note of the asset now, but historically, overhype among the crowd is something that has tended not to end well for cryptocurrencies, so this trend could be one to keep an eye on.

ETH Price

At the time of writing, Ethereum is trading around $3,400, up more than 23% over the last week.

The price of the coin appears to have sharply been going up | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.