Is A $2,000 Ethereum Rally Imminent? Market Trends Hint At Possible Breakout

After months of downward pressure, Ethereum (ETH) may finally be poised for its next major move upward. The second-largest cryptocurrency by market capitalization appears set to benefit from several bullish trends – ranging from technical setups to improving institutional demand – that could propel it toward the psychologically significant $2,000 mark.

Ethereum Heading To $2,000?

ETH has shown notable momentum over the past week, rallying from around $1,575 on April 22 to approximately $1,830 at the time of writing. This nearly 20% increase has rekindled bullish sentiment across the market.

Technical analysts believe this recent surge could be the beginning of a larger move. In an X post, analyst Kiran Gadakh shared a 12-hour ETH chart, noting that if ETH confirms a 4-hour candle close above resistance – marked by the red line – it could soon target the $2,000 level.

At the same time, Ethereum spot exchange-traded fund (ETF) inflows are gaining momentum. Data from SoSoValue shows that ETH spot ETFs saw over $64 million in inflows on April 28 alone. More notably, the week ending April 25 marked the first time since February 2025 that ETH ETFs experienced a positive weekly net inflow.

Currently, the total net assets held in US ETH spot ETFs stand at $6.20 billion, representing approximately 2.87% of Ethereum’s total market cap. Meanwhile, cumulative net inflows into these ETFs have reached $2.47 billion – a clear sign of growing institutional interest.

Further supporting Ethereum’s bullish case is a surge in institutional demand. CoinShares data revealed that ETH investment products attracted net inflows of $183 million last week. This breaks an eight-week streak of consecutive outflows, suggesting a potential shift in investor sentiment.

Ethereum’s decentralized finance (DeFi) ecosystem is also seeing a resurgence. According to DefiLlama, the total value locked (TVL) in Ethereum-based DeFi platforms has jumped more than 10% since April 22, now sitting at $51.67 billion.

ETH Not Completely Out Of The Woods

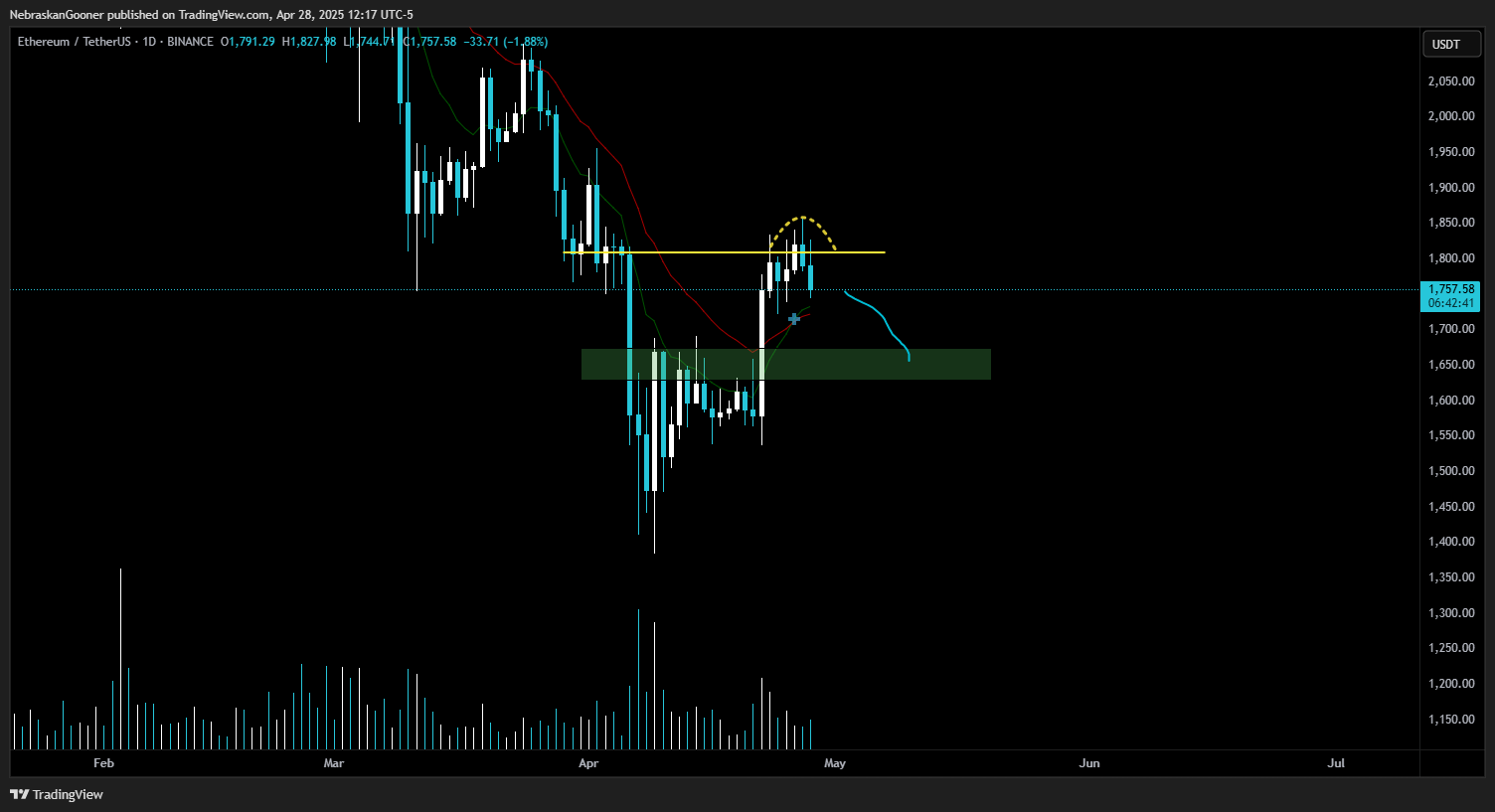

Despite this promising data, not everyone is convinced that Ethereum is out of the woods. Crypto analyst Nebraskangooner described ETH’s recent price action as “sloppy.” He noted:

Sloppy price action. The fact that this deviated above resistance and is rejecting on increasing volume makes me think it will drop back to this support zone below.

Still, dwindling ETH reserves on exchanges are fueling speculation about a potential supply squeeze. If this trend continues, it could provide the necessary momentum for ETH to breach $2,000 and sustain higher levels. At press time, ETH trades at $1,819, up 3.5% in the past 24 hours.

Featured Image from Unsplash.com, Charts from X and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.